A decade ago, the number of export-oriented suit-making factories in Bangladesh was one or two, and China and Vietnam were the main sourcing destinations for brands and retailers globally.

In fact, Bangladesh was lagging in the production of value-added garment items due to the dearth of technologies and skilled workforce.

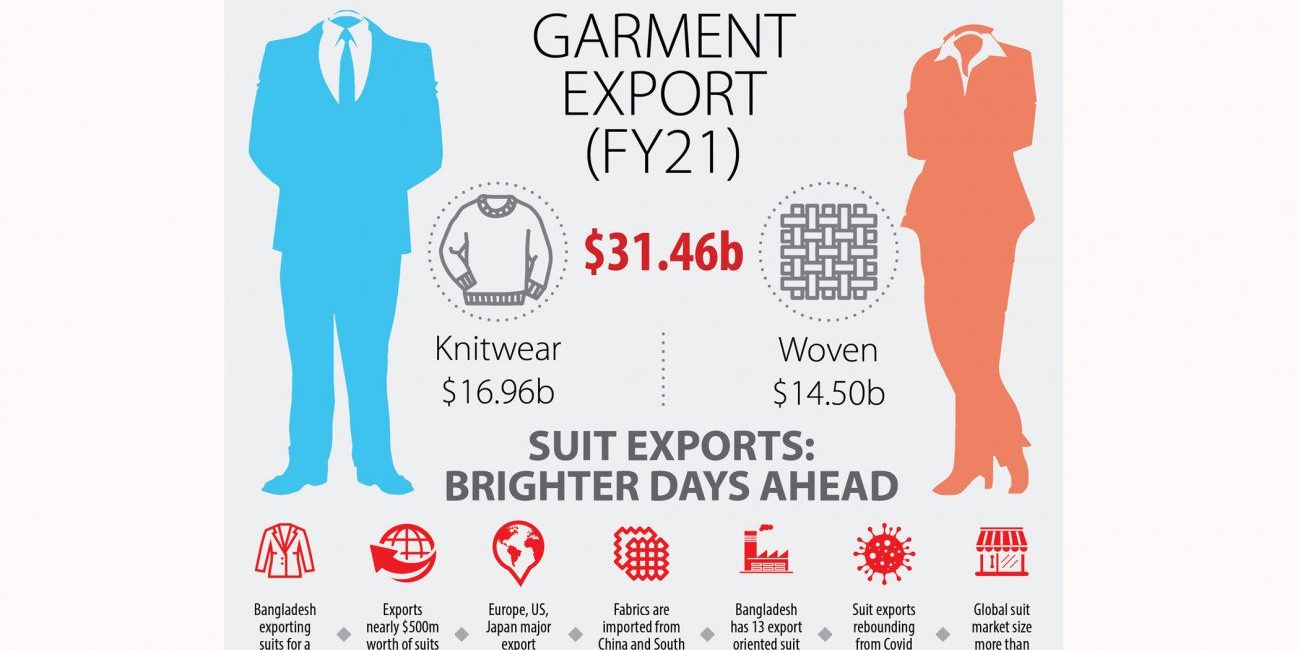

Today, Bangladesh has emerged as a major supplier for high-value suits for many reputed retailers and brands in Europe and the US, propelled by the investment in the segment and adoption of advanced technologies to grab a pie of the global market valued more than $160 billion.

The number of export-oriented suit-making factories has gone up to 13, which are fetching nearly $500 million annually.

Humayun Rashid, chairman of Energypac Fashions Ltd, set up his factory in Gazipur in 2007 with a goal to produce value-added garment attires. Currently, he exports 5.9 million pieces of suits every year, earning more than $55 million.

What is more, the entrepreneur is going to expand manufacturing capacity from February as retailers and brands are placing higher orders with the factory.

After the planned expansion, 2,500 additional pieces of suits would be added to the current daily production capacity of 16,000.

The high-range value-added suit produced at Rashid’s factory commands a price of $300 and above.

The export price of a mid-range suit is between $150 and $300, while a low range suit is priced between $99 and $150 per piece, according to Rashid, whose clients include many reputed European and US retailers and brands.

The country manager of a major clothing retailer of the UK says 10 years ago the British brand was desperately looking for suit-making factories in Bangladesh as demand was high.

“Today, Bangladesh has turned into the largest suit sourcing destination for my company,” said the executive, giving credits to local manufacturers, who have invested heavily and installed modern technologies.

The UK retailer now purchases nearly $20 million worth of suits and trousers from Bangladesh every year, out of its total sourcing value of more than $1.2 billion from the country.

“The suit segment is offering a lot of prospects for future growth,” said Shahidullah Azim, acting president of the Bangladesh Garment Manufacturers and Exporters Association.

“We export more than Vietnam does in terms of volume. But the value is lower as we are confined to five basic garment items.”

Mohammad Ali Khokon, president of the Bangladesh Textile Mills Association, says local textile millers don’t have significant capability to supply the fabrics used in making suits despite higher demand. As a result, manufacturers mainly import the fabrics from China and South Korea.

The sourcing of suits, blazers and other woven formal garment items from Bangladesh had slowed down during the peak of the coronavirus pandemic as demand dropped. The business is now rebounding thanks to the waning of infections.

“The suit business is also picking up in the western markets in keeping with the re-opening of economies in the Europe and the US,” said the country chief of the British retailer.

“But, if the Covid-19 situation deteriorates, the business of formal clothes, especially suits, will again be affected.”